Why The Federal Debt Isn’t Something to Panic Over (Yet)

The high US debt levels have been a popular topic of media attention, especially since the COVID crisis, when rapid stimulus led to rising inflation and a faster-growing debt load for the nation.

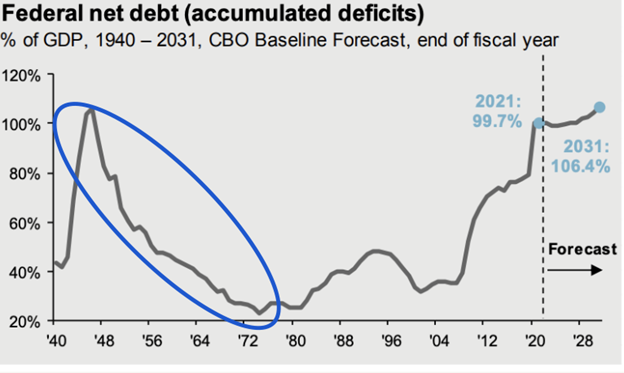

While I strongly discourage excessive borrowing in personal finances, I don’t think the nation’s debt load is out of control. For one, the debt relative to the nation’s output (GDP) is relatively stable. Despite an increase over the past few years, the amount the US spends on interest payments is still below the levels of 1980-1990.

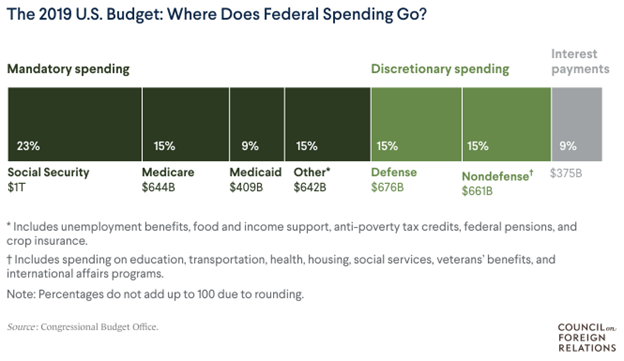

Also, a significant amount of the budget that adds to this debt is stimulative to the economy because it puts money directly in people’s pockets (Social Security, medical benefits, pensions, etc.). These funds are then turned around and spent throughout the economy.

Levers must be pulled eventually to stabilize our debt balances, but we are not doomed to face a Great Depression. The U.S. has an extensive history of adapting and pulling those levers when we head too far in one direction. For example, after the U.S. took on high levels of debt to fund WWII, taxes were raised, and some spending programs were cut, all while stimulating the economy through other programs that made buying homes, cars, and other goods more accessible to consumers. In the sharpest reversal in debt levels our nation has ever seen, a chart that was going up turned quickly south.

At some point, we will have to make similar tough decisions. However, if done correctly, we can grow out from this debt through consistent economic growth, prudent tax policy, and thoughtful spending plans. We have done it before.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.