Is Buying the Biggest Stocks In the S&P 500 a Bad Idea?

The S&P 500 is at some of its highest concentration levels ever. The top 3 stocks make up over 20% of the entire index’s value. That means it’s quite difficult for the market to do well without these companies performing well. Thankfully, they have delivered. Starting in 2016, they even got their own acronym (FAANG—standing for Facebook (META), Apple, Amazon, Netflix, and Google—since then, Microsoft and others have been added).

Many called it a top in these companies back then, but big tech has continued to carry the market higher. This is one of the rare instances in which investing with the consensus actually worked. They just kept going higher. Despite some hiccups along the way, they all have outperformed the index.

With the significant outperformance lasting almost a decade after this trend was widely acknowledged, many market pundits are asking if it can continue.

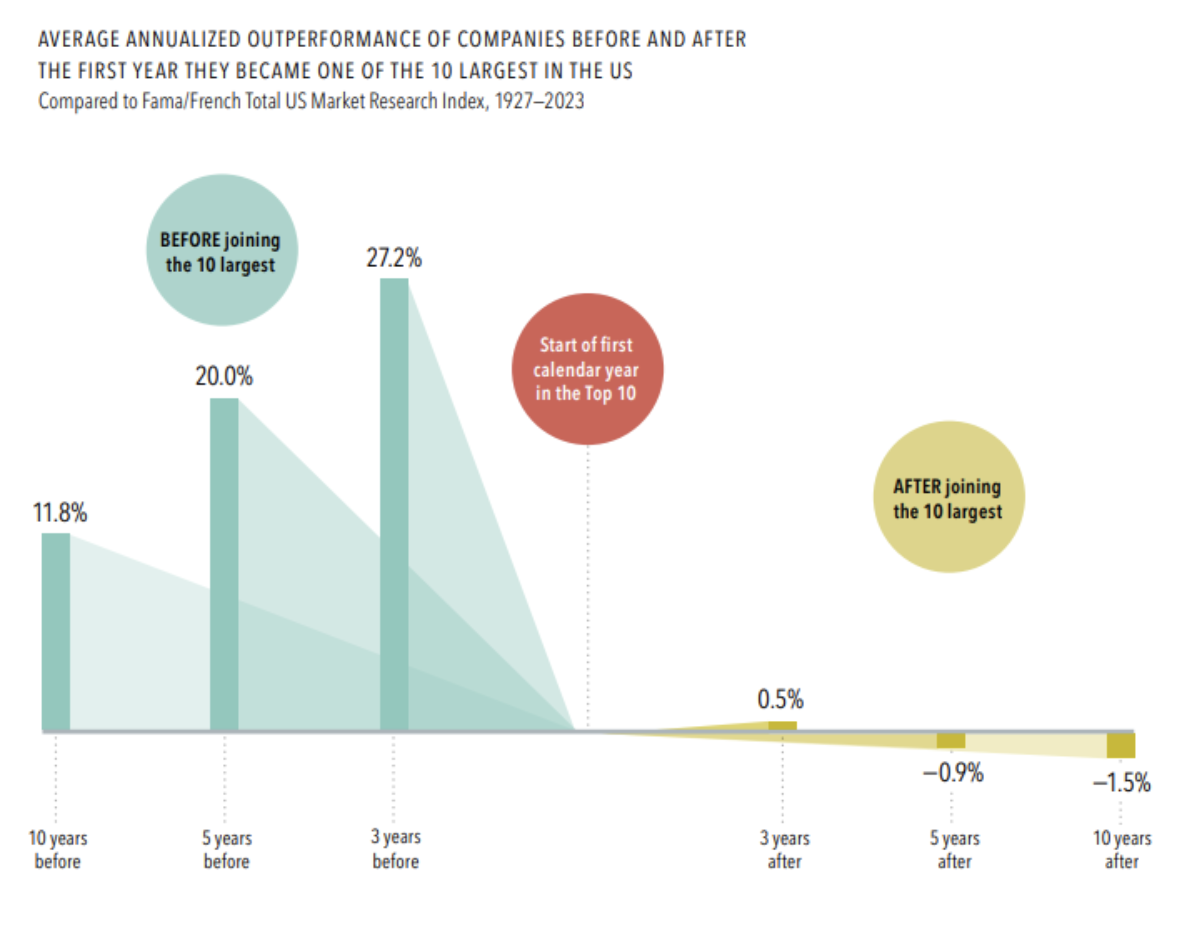

Historically, the largest companies in the index tend to have great past performance (that’s how they got there in the first place) but average future returns.

Since 1927, once a company becomes one of the top 10 largest companies, it tends to slightly outperform the index (.5% higher) over 3 years and then begins to underperform over 5-10 years. However, there are certainly exceptions to the rule. After all, many of the biggest names today were the biggest names a decade ago and have continued to outperform.

Historically, buying the biggest names is not a prudent strategy for your entire portfolio. But I don’t think the data is conclusive enough to say don’t own any of them. Just be sure to size your position appropriately so that if you get underperformance or a complete meltdown (think GE, Nokia, etc.), your financial plan doesn’t also meltdown!

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.