How Investors Can Be Right and Wrong at the Same Time

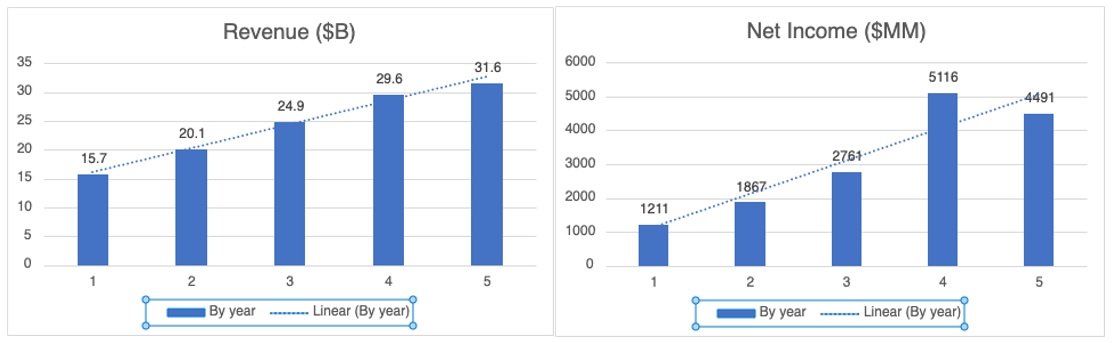

One of the most frustrating parts of investing is that you can be right and wrong at the same time. Recent Netflix stockholders know this all too well. The story about Netflix back in 2018 was that their subscriber base was breaking out and that tremendous growth was ahead. And they were right. Check out these numbers over the past 5 years.

Revenue doubled and net income nearly quadrupled over that time. Investors who nailed those forecasts were rewarded by underperforming the S&P 500 by about 50%.

This is one example of many that demonstrate just how challenging stock picking can be. Market expectations matter a lot. In the case of Netflix, the market had been pricing in the anticipated growth for many years prior to 2018. So, when the growth happened, investors shrugged their shoulders and moved on.

Before investing based on a hunch, ask yourself “What do I understand that the rest of the market doesn’t?” If the answer is nothing, your optimism or pessimism may already be reflected in the current price.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.