Some Thoughts on the Recent Market Volatility

Last Tuesday, March 11th, the S&P 500 hit the official “correction” level midday - 10% off the all-time highs set just 20 days earlier on February 19th. It was the 5th fastest 10% decline in the past 75 years, driven primarily by tariff uncertainty.

Below are a few thoughts I’ve been thinking about for the past few weeks. As always, I’ve done my best to be as apolitical as possible.

Tariffs are a bad idea.

Tariffs are rarely a good economic tool. While they may be implemented to protect domestic industries, they often lead to increased costs for businesses and consumers. Higher input costs reduce corporate profits, economic growth, and, ultimately, stock prices. Historically, tariff disputes have created uncertainty that weighs on investor sentiment, causing short-term disruptions in financial markets.

The market has priced the risk.

Depending on which side you hear from, the media seems to think tariffs and government cuts are good, OR they think this is the beginning of a US collapse. While anything is possible, the future is probably somewhere in the middle. I actually think the market has priced this risk pretty well. The S&P 500’s 9% drop reflects a reasonable adjustment to the economic implications of trade policy uncertainty. Rather than an overreaction, this decline is a rational response to potential earnings revisions for US stocks. Could it get worse? Of course. Could tomorrow be the bottom? Also, possible.

10% corrections are normal.

Market corrections, defined as declines of 10% or more from highs, are a routine part of investing. Historically, the S&P 500 experiences a 10% correction approximately once every 1-2 years. The story goes like this – a unique, often unprecedented risk looms, and then a resolution is found. Below is a table of some of the stock market corrections since 1950 that did not turn into a full-on bear market.

Corrections often recover quickly.

One of the most important lessons in investing is that market recoveries from corrections tend to happen swiftly. Over the past several decades, most 10% corrections have rebounded within a matter of months. Panic selling during downturns often leads to missed gains, as some of the best market days occur shortly after a pullback. Of course, all bear markets and crises started with a 10% correction – so that is always the fear. But that is usually not the case since bear markets have happened only once every 4-5 years on average.

This is the risk premium.

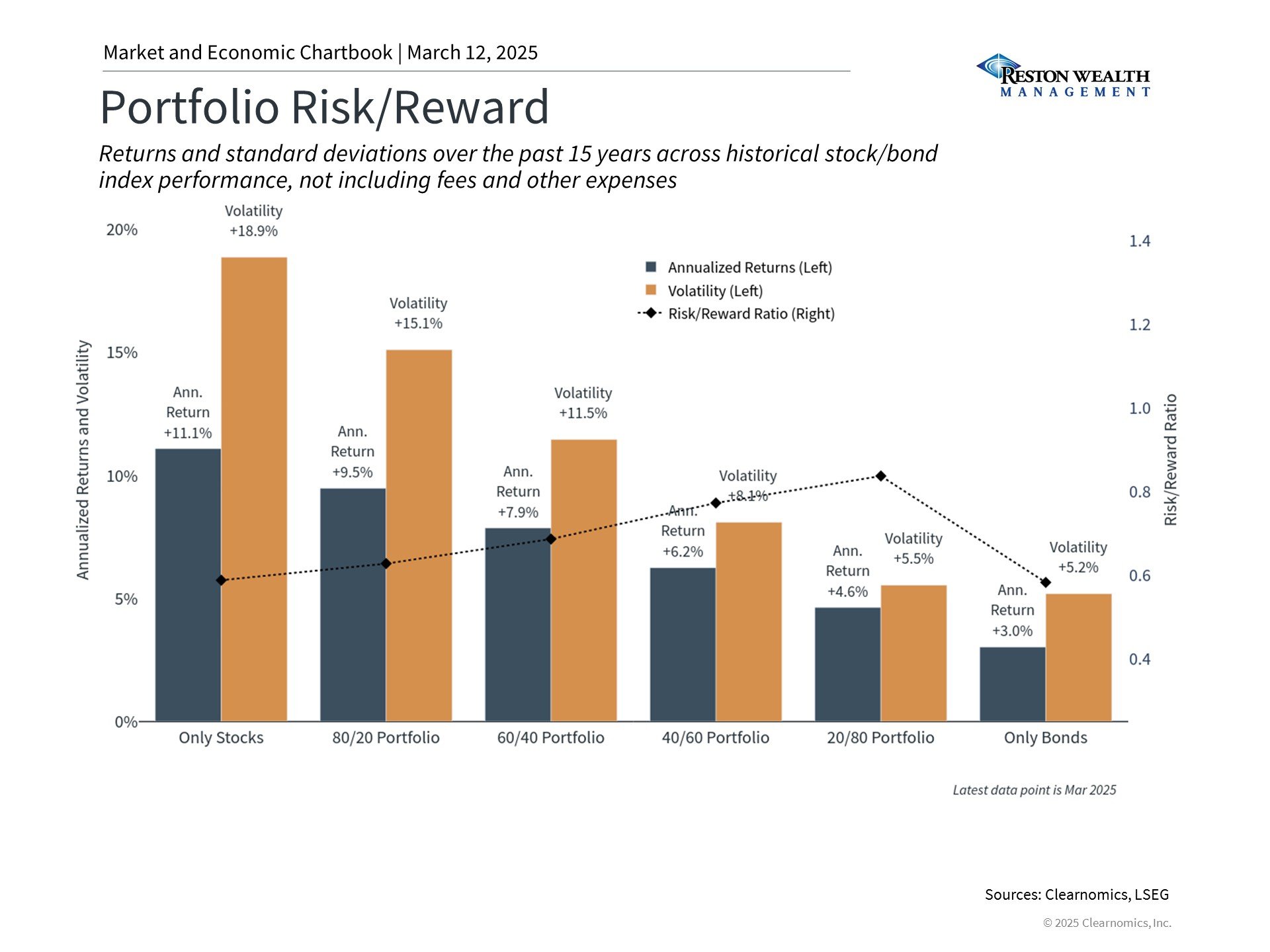

No one wants to hear this. Uncertainty is the reason stock returns are high over the long run. If investing were risk-free, everyone would be all-in on stocks, driving prices up and future returns down. Since 1950, the worst 20-year stock return was 6% annually, while the best was 18%, averaging around 10%. Earning that return required enduring world wars, nuclear threats, presidential assassinations, tech crashes, 9/11, the 2008 crisis, global pandemics, and more. The chart below illustrates that the more stocks you own, the higher your potential returns - and the more volatility you must endure. This is the risk premium. This is the entry fee you pay for what have been great historical long-term returns.

Finally, the benefits of diversification.

U.S. equities have been turbulent, but diversification has helped. Bonds, a traditional safe haven, have preserved capital, while international equities have outperformed. Year-to-date, the S&P 500 is down over 5%, but the bond index is up 2%, and the EAFE international stock index has gained 8%.

Market volatility can be challenging, but it is an expected part of investing. Tariff-related concerns, while valid, have been priced into the market to some extent, and history suggests a strong likelihood of recovery if given enough time.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.