Should You Be Worried About “The Death of the US Dollar?”

One question I’ve been hearing more recently is, “Will the US dollar collapse in the future?” It’s a fair question, given the rising levels of debt in the US and the rise of other alternative currencies (Euro, Yen, and digital currencies as of late).

No fiat currency has lasted forever across history, and I suspect the US dollar will be no exception, given enough time. But how high is the risk that we could face the “death of the dollar” during our lifetime? Let’s take a closer look.

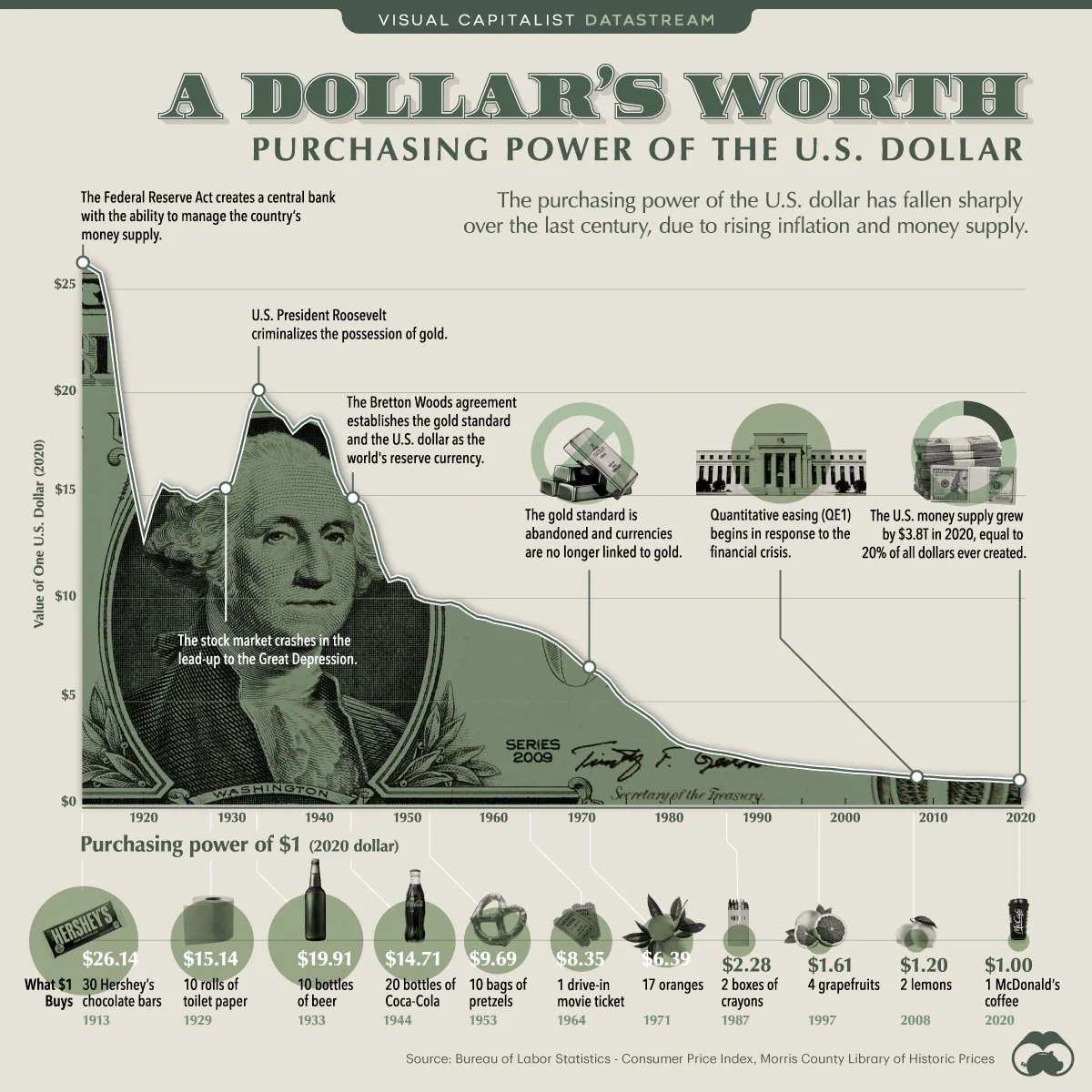

To start, inflation alone won’t kill the dollar. Inflation without growth (or GDP) will kill the dollar. By way of example, consider how the dollar’s value has shrunk over the past 100+ years.

Despite the substantial loss of purchasing power, the dollar is a larger portion of global reserves than 100 years ago. That’s possible because wages and asset values grew much faster than inflation because the people and companies in the US created things that other people and businesses worldwide wanted.

While there is a longer-term trend of demand for US dollars, the percentage of global reserves held in US dollars has shrunk more recently in the past 20 years, although slowly.

However, the US dollar remains the “least bad” of all the fiat currencies. There is no great alternative. And there appears to be a very low risk of that changing over the coming decades. Why? Because our corporations are innovating at a rate far faster than any other developing country. Many of the most valuable companies in the world (Apple, Amazon, Google, Microsoft, Nvidia, etc.) that create the products and services demanded worldwide are in the US. This creates demand for our currency since it is used to obtain those goods and services. The currencies behind the countries with the most innovation will always be in demand.

There are plenty of risks ahead – and like all empires before the US – it will likely fall eventually. However, the US appears to be positioned to remain a dominant currency in the years ahead.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.