Why Average Life Expectancy Is Deceptive

There’s an old financial planning joke about asking a retiree when they would like for us to plan their funeral. It’s a bad joke but the reality is that when we are planning for a lifetime, we do have to make an educated guess on when that life might end. I often get pushback when I suggest as late as 90 or 95. That pushback is fair given that the average life expectancy is about 77 – 15 to 20 years less than I would typically plan for. But average life expectancy can be deceiving.

Take 2020 as an example. Tragically, over half a million people lost their life to Covid-19 in the US. And not surprisingly, the average life expectancy dropped from 79 to 77.

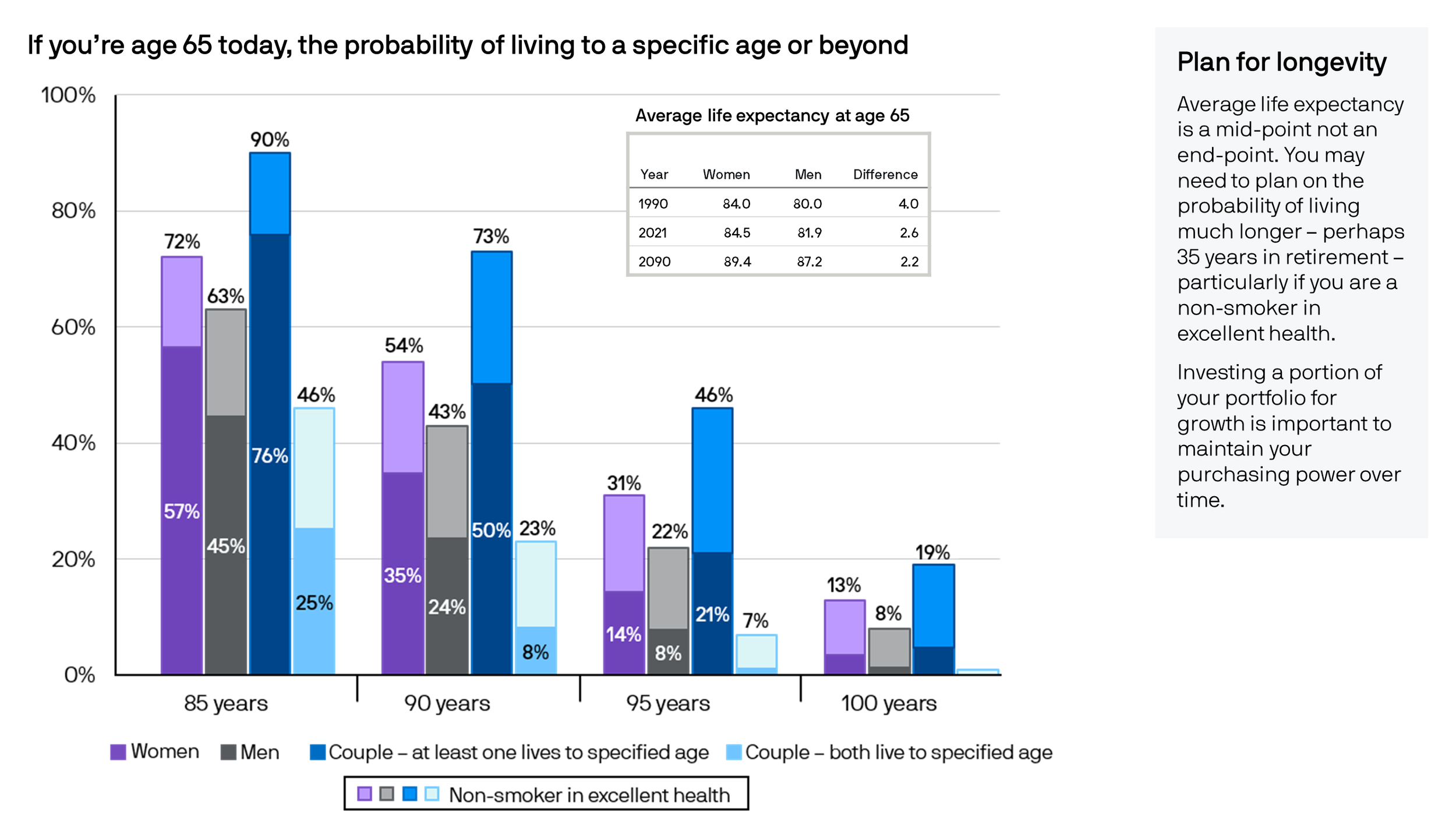

However, if you are alive and healthy, that drop in life expectancy is irrelevant. The same is true for other tragic and premature deaths like car accidents, heart attacks, and a multitude of serious diseases that unfortunately bring the average life expectancy down. The fact is that if you are alive and healthy today, you are considered above average and should plan accordingly. The data suggests that if you are 65 years old and don’t smoke, there is roughly a 25% chance you will live to 95, and if you are married there is nearly a 50% chance one of you lives to 95!

JPMorgan 2023 Guide to Retirement

And this doesn’t even include the fact that all of these averages are steadily increasing year after year (with the exception of the pandemic last year). The average lifespan has increased since 1970 from about 72 to 79 according to the US Census, and they expect it to steadily grow to about 85 by 2050.

To reflect this reality in your retirement plan, it may require a little more sacrifice today - saving more or spending less.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.